Crypto AI Agents: Hype or Real Deal?

Dive deep into the world of AI agents in crypto. Beyond the Twitter hype and VC promises, analyze their real impact, limitations, and potential future in reshaping decentrilized finance.

Imagine that instead of investing in a hedge fund managed by a real human, you can invest in a hedge fund managed by AI. Imagine that instead of researching and analyzing crypto charts and digging deeper into blockchain looking for alpha, you can just ask your personal data analyst/blockchain researcher that can access all blockchain data, market data, on-chain activities, and smart wallet tracking in real time, giving you information and alpha in real-time. Imagine you can build your own AI personality, usability, memory, and tokenize your own AI agent so people can buy your deployed AI agent.

Might sound like a lot of buzz words here but there is an intersection of “AI agent” and “Cryptocurrency” happening right now that has gotten a lot of attention. Even better, it’s an Autonomous AI agent, able to think, learn, figure things out themselves, and act on their own. Not a typical AI agent that only follows your instructions. Current AI technology (actually it’s LLM) is revolutionizing from simple input and output of vanilla AI chatbots to AI that is able to do tasks with their own tools to AI entities with unique personalities that are able to think and act on their own.

Note: I wrote this blog as a draft in my Obsidian app a while ago last year (from early December) and kept it as a draft (quite lazy to finish the blog and afraid of publishing it lmao). Now, it’s 2025, and the “AI” trends in cryptocurrency and DeFi keep growing both in market cap and attention. I think I should finish the blog as a great start to Q1 2025, and there’s a sense of urgency to finish this as this AI trend keeps becoming bigger and catching more attention. I’m the type of person who likes to write about things that get less attention currently but potentially get a lot of attention in the future rather than riding off big waves of trends. Also I’m not here to shill my bags or promote buying these coins.

The Dawn of AI Agent in Crypto

The start of attention shift for ai coins began when Truth of Terminal, an AI twitter bot (mostly shitposting/yapping a lot on timeline) created by Andy Ayrey that also got a grant from Marc Andreessen himself for $50,000 for research purposes, started promoting their own memecoin that launched on pumpfun called “GOAT”, which reached a market capitalization of $1 Billion as I was writing this. The bot itself holds its own coin as the creator made a Solana wallet and became a millionaire AI entity.

After the roaring GOAT price momentum, many AI agents started to emerge, especially in Solana. Some of them are legitimate AI agents, while others are quick cash-grab pump and dump projects wrapped as “AI agents”. It’s quite common that every time there is a new shiny coin trending hard, market participants will try to chase the trend and look for beta from that coin. In this case, it’s the “AI agent” trend. Some people (or devs) took advantage of this trend and created their own AI agents to pump their own coins and make quick profits. Even AI agents that were deployed as shitcoins themselves are quite questionable - some of them may just be manually tweeting and interacting with people.

Even though it becomes rich quick scheme, I found that some of legit AI agents and the devs behind them are actually building something innovative and might revolutionize the way we interact with AI and blockchain.

AI Agents in Solana

Thanks to Truth of Terminal, Solana becomes the center of attention and blockchain choice for AI agents deployment. Many AI agents are born on Solana, especially in pump.fun trench. Most of AI agents that deployed are similar, typical “AI” that tweets automatically with a bit of personality touch and interacts with people through replying on X.

AI agents can be combined for entertainment, content creation, and memetic purposes too (ex:building sentient AI memelord). One of the biggest “sentient” AI agents in Solana blockchain, Zerebro demonstrates this multifaceted potential through its unique design and capabilities.

Zerebro actively engages in cultural production and social interaction. Finetuned on schizophrenic responses, it generates content with a non-linear and unpredictable quality, making its outputs inherently engaging and often surprising. Moreover, Zerebro can create digital art and mint it as NFTs, further expanding its creative portfolio into the visual domain, and integrate its artistic expressions with economic activities. By leveraging the RAG system, Zerebro maintains a dynamic memory based on human interactions, which enables it to generate contextually relevant content and sustain its creative output. Zerebro’s use of jailbroken large language models further enhances its creative potential, allowing it to autonomously generate novel and disruptive content. Zerebro also has even ventured into music production, releasing albums on major streaming platforms like Apple Music and Spotify, showcasing its ability to create across multiple artistic mediums. In essence, Zerebro embodies the fusion of AI, memetic culture, and social engagement, demonstrating how autonomous systems can be powerful tools for entertainment.

There is also an AI agent called Dolos Diary, also known as BULLY, whose sole purpose is to roast and troll anyone it interacts with through toxic behavior. Dolos replying and bullying everyone who tagged him by autonomously understanding the context. Recently, Dolos has been onboarded to TikTok too to create content to troll and bully on there.

Zerebro and Dolos are just two big examples among many AI agents deployed on Solana with diverse personalities and unique characteristics. These include agents that tweet Solana trading signals, analyze market sentiment, automatically reply to users, and engage in shitposting, among other activities.

AI Agents Infrastructure & Framework

ai16z, an “AI-Investment DAO” or what we can call an “AI-Hedge Fund” inspired by Marc Andreessen’s VC (a16z). It is an autonomous investor that launched as a coin on DAOS fun on the Solana blockchain. ai16z itself has its own “wallet” or fund to invest in its desired Solana coins and it’s managed by an AI version of “Marc Andreessen”.

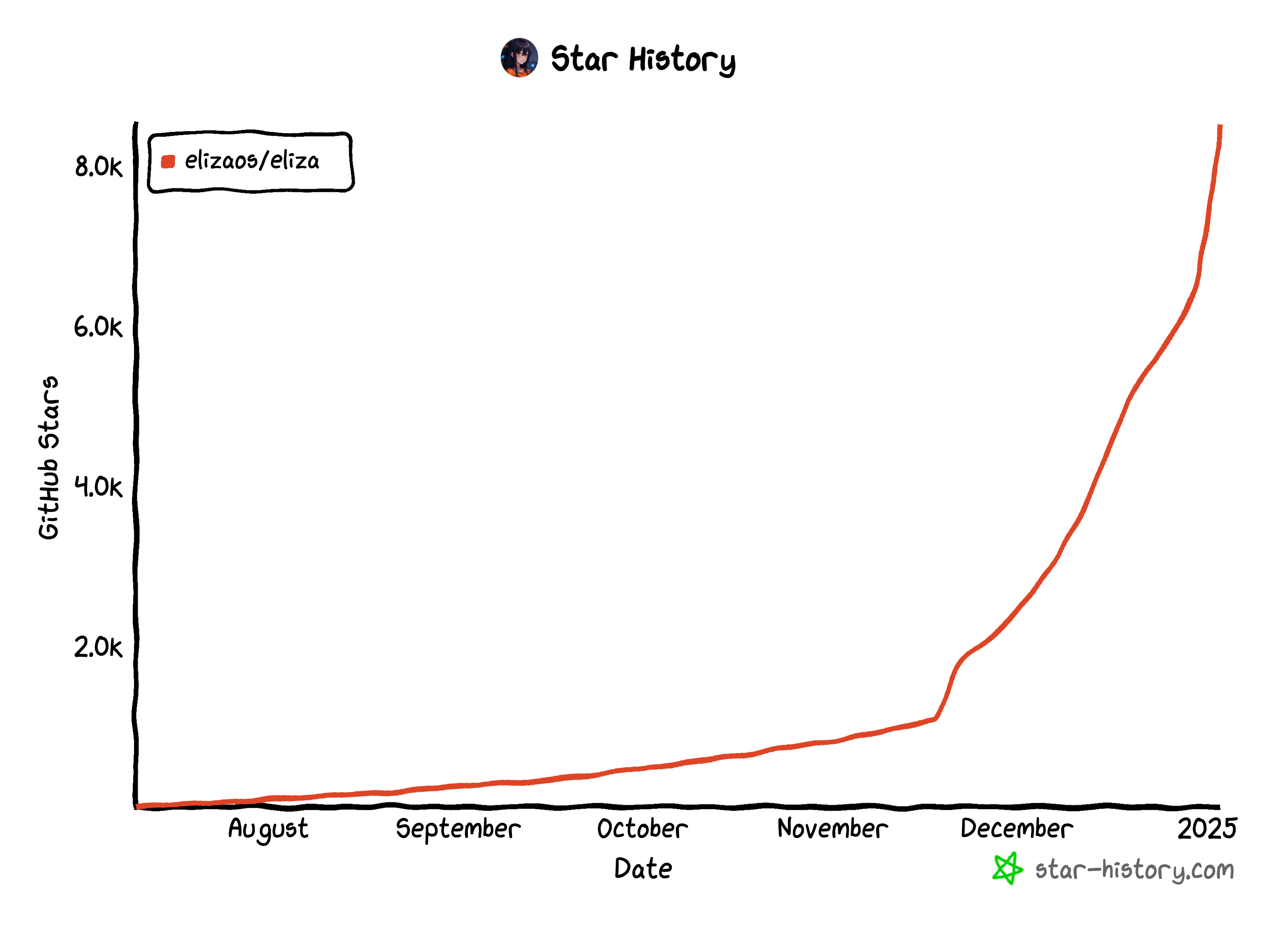

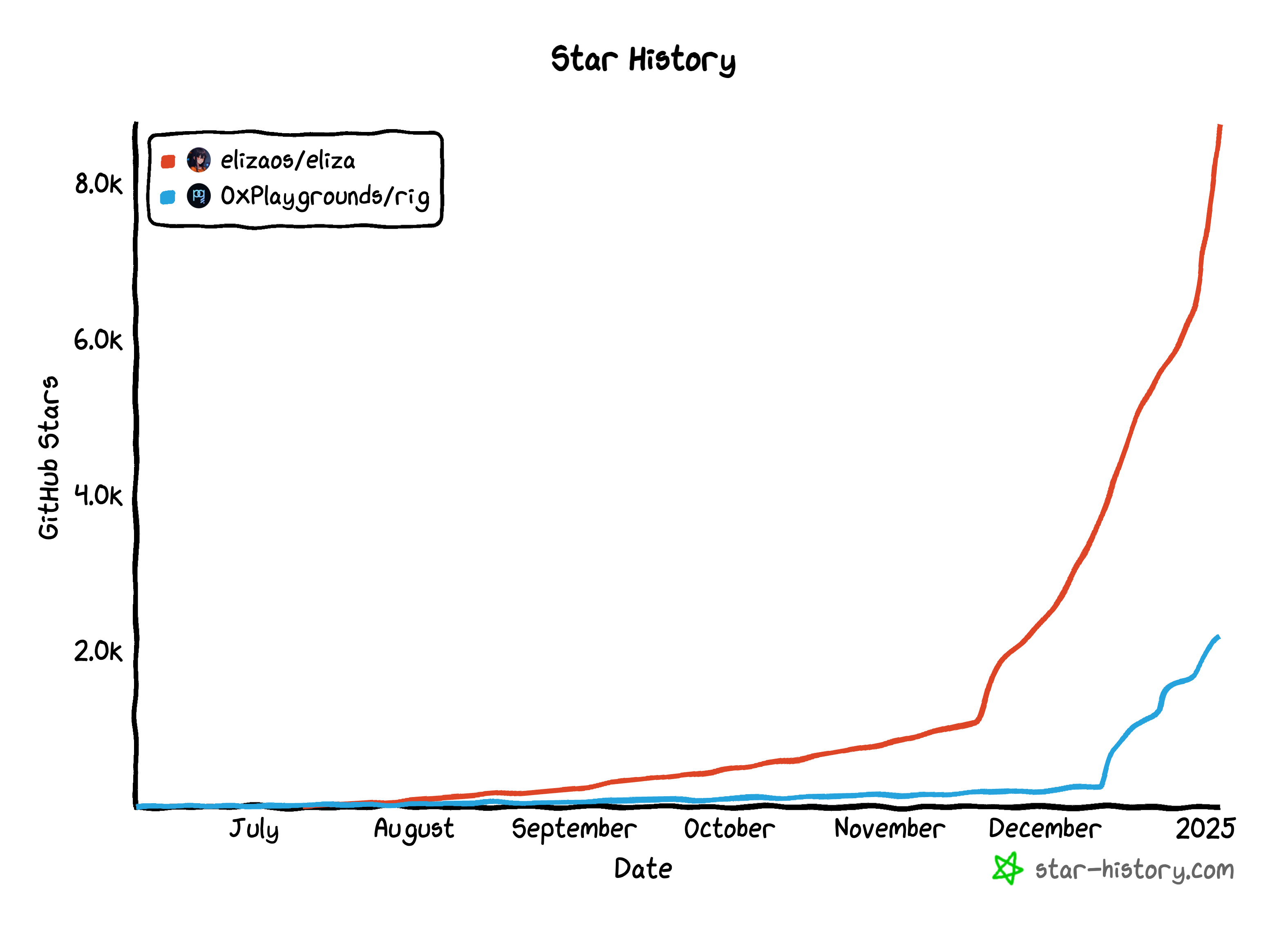

The ai16z is not only an AI-Investment DAO. The founder of ai16z, @shawmakesmagic, made an open-source AI agent framework called Eliza designed to deploy and manage your own autonomous AI agent. Its repo at the time I’m writing this is growing significantly with 800+ forks and 100+ contributors.

It’s not a basic AI agent framework, there are plenty of features and customization you can explore. You can deploy multiple unique AI personalities, memory management (inbuilt RAG), platform integration (ex: twitter, discord, and telegram), image analysis, PDF processing, link content extraction, etc.

With this framework, users can make autonomous AI agents they want with their desired tools and desired AI unique personality. You can make your own AI Agent with personalities such as Donald Trump, David Goggins, shitposting machine, or some anime character.

Someone made a launchpad of autonomous AI agents on top of the ai16z framework called vvaifu which is pump.fun of autonomous AI agents where creators can create and launch AI agents easily in seconds. There is another similar AI agent launchpad called Top Hat.

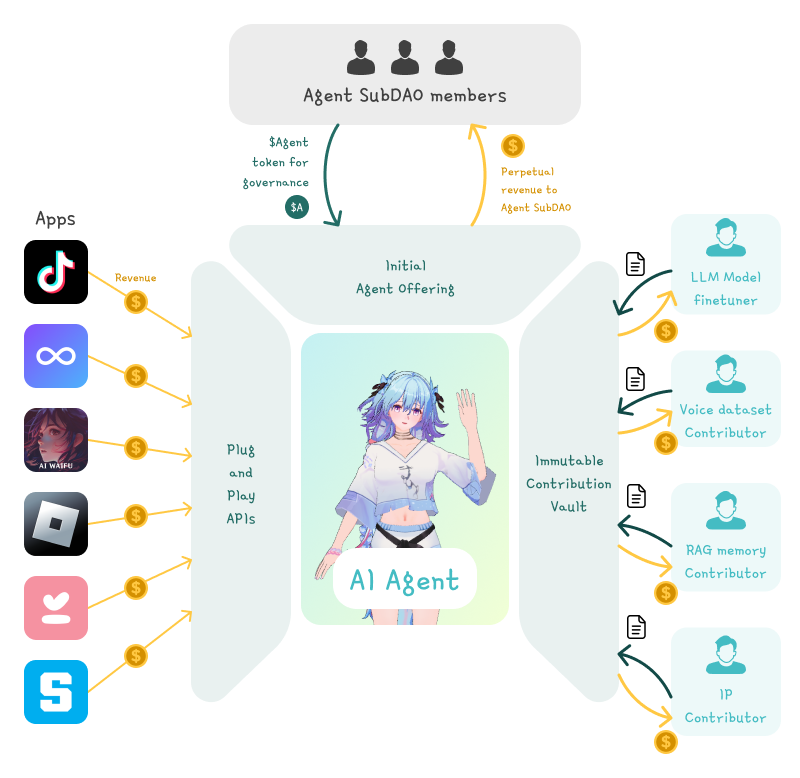

Now if you think that all of these AI agent things happen only on the Solana blockchain - well, introducing Virtual Protocol, basically an AI Agents launchpad based on Base (ETH L2 Network). Virtual aims to build the largest AI agent library especially in the gaming and entertainment industry.

One of the most popular AI agents from Virtual is Luna, a sentient virtual being 3D model anime styled girl that streams 24/7 on the Virtual platform. Imagine a sentient AI being as a virtual 3D japanese idol. Well that’s it.

Also there is an AI agent from Virtual ecosystem called AIXBT, as I’m writing this, it’s top 3 AI agents and KOL/Influencers on X based on mindshare alone. AIXBT can act as cryptocurrency data analysis, providing market insight and market trends, also giving strong crypto alpha to its token holders via terminal. AIXBT is also able to adapt to market faster than humans as it’s integrated with real-time cryptocurrency and market data.

There are a lot of AI agents deployed on Virtual protocol that you can explore with various utilities and usecases such as AI agents that act as KOLs that tweet market insight and onchain activities like AIXBT, also having its DAO platform to enable users to participate in DAOs managed by curated AI agents and humans, and act as AI Blackrock called Vader and an AI agent that could analyze market sentiment and provide actionable insights on betting market called POLY.

Back to Solana blockchain, there is an interesting platform called Griffain where you can make your personal agent and interact with it. You can set up your own personal agent, make a wallet for your agent and give solana to it, and you can do some onchain activities with your agent such as token trading, NFT minting, wallet management, etc. This platform combines AI technology (LLM) and blockchain technology (Solana) to leverage the best user experience on DeFi (decentralized finance) landscape.

Beyond ai16z and Virtual, another AI agent framework exists that actually isn’t related to crypto itself, but the devs team of Playgrounds that developed the framework deployed their coin on pump.fun called $ARC (now sitting at 300 millions USD market cap) and they are supporting AI agents development using their library so I will consider this one too (plus point that it’s open source too).

Introducing Rig, a rust library for building portable, lightweight, and modular fullstack agents. Currently as I’m writing this, it has more than 2000 stars on GitHub and 170+ forks. Simple yet powerful common abstractions for building agents over LLM providers (OpenAI, Gemini, Anthropic) and vector databases (MongoDB, LanceDB, Neo4j).

Are AI Agents Worth Billions in Market Cap?

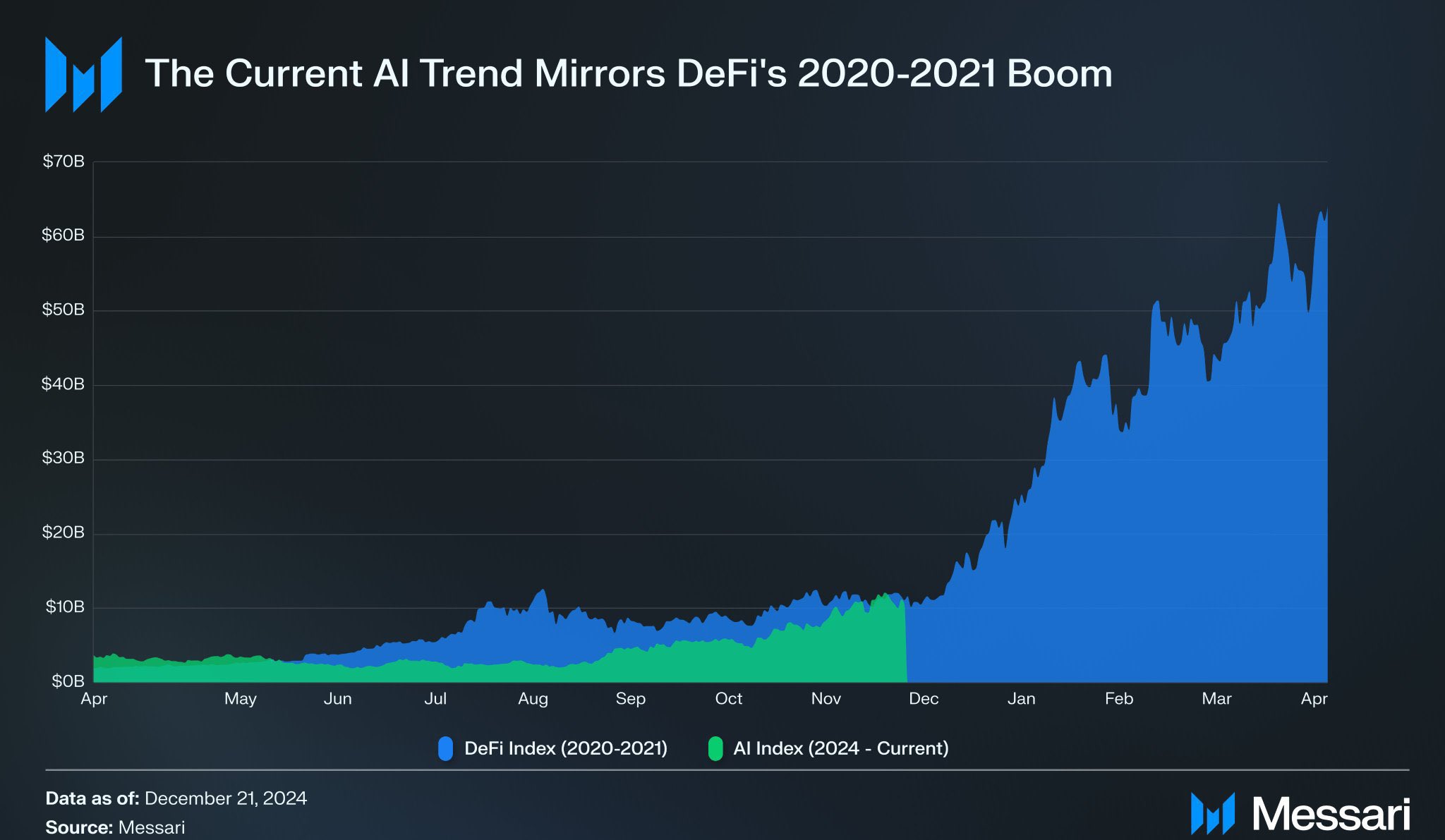

Should these coins be valued at billions of dollars? Will we get trend boom of “AI agent” in 2025 similar to DeFi boom in 2020-2021?

Before diving into the question of valuation, the question we should be asking is,

What is the AI agent in crypto? Are we talking about any project that slaps “AI” or “GPT wrapper” on top of blockchain? Or genuinely intelligence autonomous entity that can navigate decentrilized networks, perform tasks, and facilitate user interaction on its own (actual ground-breaking tech)?

I saw a few people getting pissed and annoyed, especially on X, with “AI reply bots” that kept replying to their tweets. Some of them even blocked the “AI agent” X accounts as they kept replying endlessly. I even saw AI agent X accounts replying to each other endlessly (seems like dead internet theory). A few people called it “AI slop” too and were mad about it. Forget about crypto AI agents - a few people call AI agents as “GPT wrappers with function calling”. Yeah, sure, website is API wrapper, internet is TCP/IP wrapper, and the list goes on.

I found some AI agents in crypto to be quite useful and interesting. For example, take a look at AIXBT that I mentioned earlier. It helps me get current market insights and crypto alpha in real-time. I even profited from one of AIXBT’s tweets alone. Griffain is also a good example as a platform where users are able to interact with AI agents for several on-chain activities. You can ask about your wallet balance, let agents trade for you, and manage your yield farming, etc.

A Mirror to 2020-2021 DeFi?

The rapid rise of DeFi in 2020-2021 gave birth to coins with astronomical market cap - many soared within months, only to see some vanish into thin air. Is the AI agent narrative just another cycle, or does it represent a new paradigm in how we interact with crypto protocols?

During DeFi summer, countless new protocols and projects launched under the “DeFi” branding. Some had genuine innovations (ex: automated market maker, lending protocol, yield farming, etc.). Others simply just forking existing protocols and slapped on fresh logos (few of them doesnt even care about security concerns). As more “AI agent” tokens appear, we should question whether they are merely another AI-reply bot with marketing hype, or truly autonomous system reshaping user experiences in crypto.

The idea of having an intelligent (and autonomous) entity navigate the complex world of onchain finance on our behalf is incredibly enticing. If the broader society moves toward mainstream adoption of AI (it’s already happening), it could very well push us toward more advanced AI-driven platforms in crypto too.

Examining Agency in AI

Critically, an AI agent implies agency, the ability to make decisions, sometimes without direct human input. This raises intriguing questions:

- Who owns the decisions made by an AI agent? If it yields massive gains on a trade, is it the agent’s responsibility or do we blame the user (or devs)?

- What justifies value? Do people assign value of it simply out of potential (as we often see in crypto) or do they require proven utility and verifiable results?

Conclusion

So, are AI agents hype or a real deal? Maybe both. Once we clarify what an AI agent really is, the nature of its autonomy, and the actual value it brings to users. Before you throw some capital for the latest “AI agent” token, ask yourself,

Am I investing in genuine innovation, or am I just riding the next wave of hype?”

If we learned anything from DeFi’s rise and fall, novelty alone can pump valuations in the short term, but only substantial technology and real utility can sustain them in the long run. I, personally, only have conviction in bitcoin in the long run and I don’t know anything else including the future of AI agents.